Read Time: 5 minutes

Group benefits are an important part of your employees’ total compensation. The quality of the program shows your employees that you care about them and their well-being. Just having the program is not enough. The benefits offered to them are a promise to provide them with the resources and protection for an unexpected illness or injury. Your role as a plan administrator is extremely important to ensure that you deliver on that promise when they need it.

In a fast-paced world, with limited resources, and tight deadlines, the administration of the plan is yet another task in a long list of “to-dos”. However, this is an important task that requires your attention. To make this task a little easier and help deliver on that promise, we wanted to send this reminder of some of the best practices to follow.

The Consulting House and our amazing team are always ready and willing to meet to review your administrative practices, provide tips and ideas to improve your employees’ experience, as well as reduce your company’s liability.

When it Comes to Group Insurance Programs, a Simple Mistake Made by the Plan Administrator Can Result in a Substantial Legal Liability to the Company.

Here are six of the more common tasks. Please feel free to arrange a meeting with us to review your plan administration to ensure you are following these best practices.

- Mandatory Enrollment: Our recommendation to all clients is to require that all eligible employees be enrolled in the plan. We advise against a plan that allows an employee to opt out (also known as a non-mandatory plan). The potential liability is simply not worth it. All parties are at risk of liability if an employee who was permitted to opt out of the plan becomes critically ill, disabled or passes away. Law firms actively seek and advertise for individuals to contact them in these situations, offering free consultations. Many past court cases have established that employers should adopt a paternal role in educating employees about the importance of the benefits plan and the risks of not enrolling.

Tip: If the employee absolutely refuses to join the plan, then it is strongly advised to have a legal waiver signed by the employee, and their spouse/partner (if applicable) to reduce potential liability. The waiver should be reviewed and signed annually by all parties (employee, spouse and plan sponsor). Even with a signed waiver, the courts often side with the employee.

- Enrolling a New Employee on the Plan: new hires should be enrolled within the waiting period (normally 3 months) and within 31 days of their effective date to avoid being subject to medical questions (referred to as late applicants). These late applicant employees may be declined or receive a reduced dental benefit in the first year.

Tip: Have your employees complete the enrollment at the same time as they

complete all the necessary forms to begin their employment with your company. If the employee is let go before the probationary period expires, be sure to remove the employee before their effective date.

- Notify the Insurance Company of Life Events: An employee getting married, having a child, separation or divorce, loss of spousal coverage, terminations, etc. are considered to have experienced a “life event” and this requires notification to the insurance carrier within 31 days of the “status change.” Failing to do so can result in benefits being declined or reduced.

Tip: We can supply you with posters to place in common areas or send you an email to distribute on a quarterly basis to remind your employees.

- Ensure Beneficiary Nominations are Up to Date: the beneficiary designation for the life insurance benefit is a legal contract. The person (or persons) who will receive this Life insurance benefit is called a Beneficiary and it’s important to keep this nomination up to date when a life event occurs.

Tip: Remind employees to regularly review and update their life insurance beneficiary.

- Life Insurance and Long-Term Disability (LTD) Amounts Based on Salary: It is important to ensure that all employees are informed of the amount of Life Insurance, AD&D and Long-Term Disability coverage they are eligible for based on their salary. Should an employee experience an illness or injury, the LTD benefit will replace a portion of their income. If the amount that an employee is receiving is less than what it should have been, that could post a substantial liability for an employer.

Tip: Advise your employees in writing of your plan’s overall and non-evidence maximums for Life and LTD and provide them with related medical evidence (ME) applications. As your trusted Plan Advisor, we can assist with draft communication.

- Reporting Salary Changes: Reporting salary changes for employees is imperative to ensure that any Life or Disability benefits paid are based on the latest earnings. Failing to keep salaries up to date could also result in a liability to the company.

Tip: Update an employee’s salary when it is increased along with your HR and Payroll systems. HRIS integrations may also be available through your carrier or third-party providers. Ask us for more information.

These are six of the most common administrative tasks that could pose a risk to you and your company. We are ready to meet with you to go through our checklist to make sure you are doing everything you can to reduce your liability.

We know that even the best-laid plans can go off track. That is where your company’s Commercial General Liability insurance can provide important protection.

Ensure Your Plan Administrator is Properly Equipped, and Be Sure to Add Plan Administration Liability Insurance

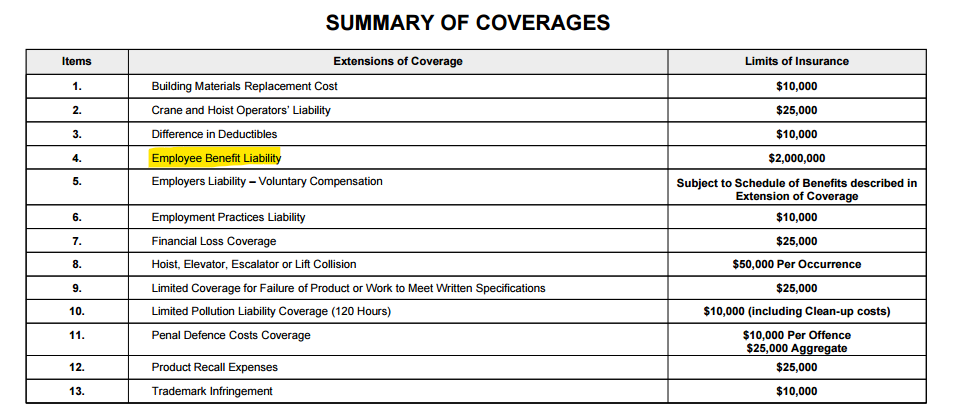

Although having your employee sign a waiver is helpful, courts often side with an employee in a lawsuit. For this reason, we recommend adding Plan Administrator Liability Insurance. This coverage can be added as a rider to your business liability insurance policy (Commercial General Liability insurance) and may in fact already be included in your policy. It provides coverage if an error or omission is made in the administration of the Company’s group benefit plan. In some cases, there are no additional costs to add this valuable coverage. Below is an example of Employee Benefits Liability insurance in a Commercial Liability policy.

We recommend that you contact your general insurance broker to find out if this coverage is included in your policy. If you do not have a broker, or are not happy with your existing relationship, we would be happy to provide you with an independent broker who specializes in general insurance.

As always, feel free to contact us with any questions or concerns you may have.